RentRedi Survey: Smaller Landlords 60% More Likely to Enforce Renters Insurance

Joint survey from RentRedi and BiggerPockets highlights market need for tech-driven solutions to renters insurance verification

NEW YORK, June 24, 2025 (GLOBE NEWSWIRE) -- A new joint survey from RentRedi, the fastest-growing landlord software that makes renting easy for everyone, and BiggerPockets, the largest online community for real estate investors, reveals that while most landlords understand the difference between renters insurance and landlord insurance, many still don’t require it—and even fewer take steps to verify it. These results, together with a companion survey conducted by RentRedi alone, highlight that many real estate investors are still exploring the best ways to implement and manage renters insurance within their rental process.

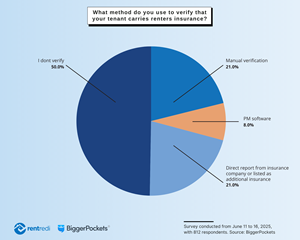

The joint survey with BiggerPockets, conducted from June 11–16, 2025, gathered responses from 812 real estate investors and property owners. When asked how they verify renters insurance coverage, half of respondents reported that they currently do not verify whether their tenants have renters insurance. The rest rely on a mix of manual checks, insurance company confirmations, or property management software, demonstrating that many landlords are still exploring the best ways to integrate renters insurance into their rental process.

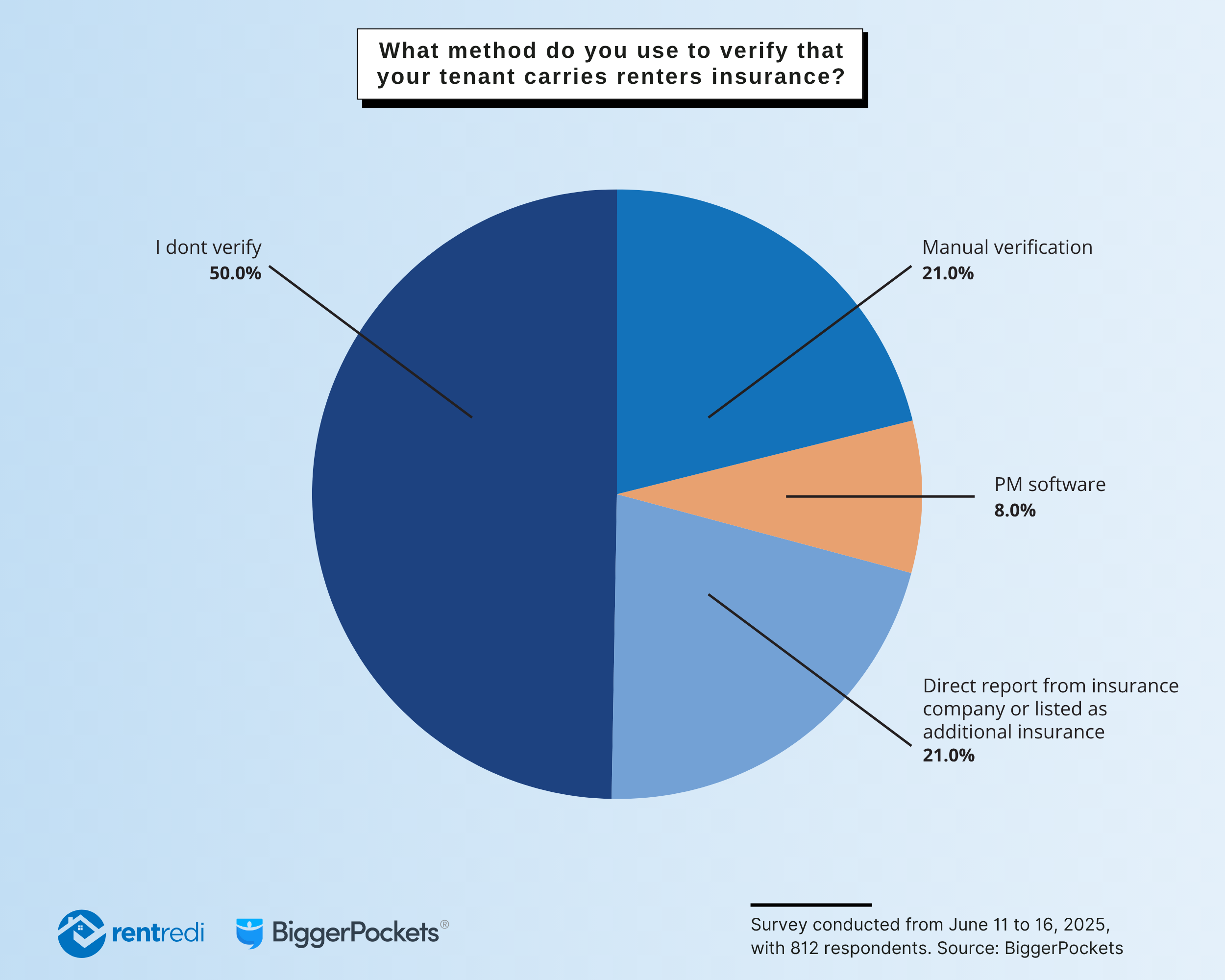

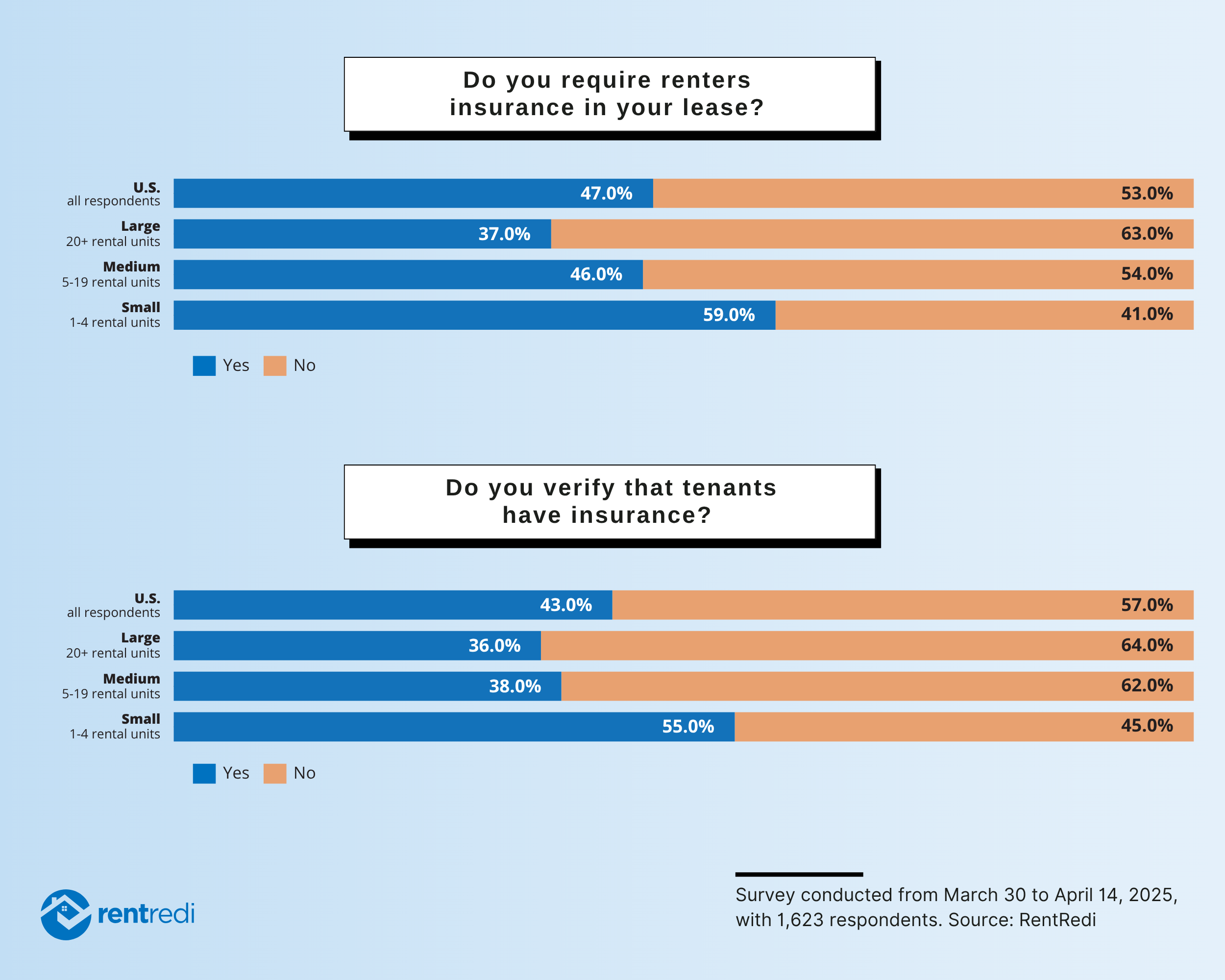

This snapshot complements a broader RentRedi survey conducted from March 30 to April 14, 2025 with 1,623 respondents that analyzes landlord behavior across portfolio sizes. The data shows that more than three-fourths of landlords understand the difference between landlord and renters insurance. However, only about one in five landlords offer renters insurance options directly to tenants, and fewer than half include renters insurance as a requirement in the lease.

Verification and enforcement also vary widely. Roughly four in ten landlords said they follow up to confirm tenants have active coverage, and among those who include a requirement in the lease, the majority—nearly three out of four—said they enforce it. These numbers reflect a growing interest in formalizing and standardizing renters insurance policies as landlords seek to reduce risk and increase protection for both themselves and their tenants.

Interestingly, landlords with smaller portfolios (1–4 units) were more likely to require and enforce renters insurance. Nearly six in ten small landlords said they include renters insurance in the lease, and four out of five of those said they enforce that requirement. While larger portfolio landlords (20+ units) were less likely to include or enforce these requirements by 22 and 15 point margins respectively, they may benefit most from automation and integrated software solutions to help manage renters insurance at scale.

“Renters insurance protects everyone involved. It minimizes financial risk, reduces liability, and gives both landlords and tenants greater peace of mind,” said RentRedi Co-founder and CEO Ryan Barone. “These results show that landlords recognize the value but often lack a streamlined way to implement it, and that’s exactly the problem that RentRedi solves.”

With RentRedi, landlords can easily offer renters insurance options during the application and onboarding process, require proof of coverage within the lease, and automatically verify compliance. Tenants can purchase renters insurance directly through RentRedi’s app, or upload proof of an existing policy, and landlords are notified instantly. RentRedi also integrates with select providers to enable real-time tracking and add landlords as additional insured when needed. The result is a simpler, smarter way for landlords to protect their investments, while also delivering a better experience for tenants.

In both surveys, percentages have been rounded to the nearest whole number. The full survey results can be found here. This report is part of RentRedi’s ongoing initiative to surface real-world insights from landlords and property managers through data, direct surveys, and collaborations with trusted communities like BiggerPockets. For more data insight and survey result reports, visit RentRedi’s Rental Market Insights.

About RentRedi

RentRedi offers an award-winning, comprehensive property management platform that simplifies the renting process for landlords and renters by automating and streamlining processes. Investors can quickly grow their rental businesses by using RentRedi's all-in-one web and mobile app for rent collection, market listings, tenant screening, lease signing, maintenance coordination, and accounting. Tenants enjoy the convenience and benefits of RentRedi’s easy-to-use mobile app that allows them to pay rent, set up auto-pay, build credit by reporting rent payments to all three major credit bureaus, prequalify and sign leases, and submit 24/7 maintenance requests.

Founded in 2016, RentRedi is VC-backed and a proven leader in the PropTech market. The company ranks No. 180 on the Inc. 5000 list and No. 13 on the Inc. 5000 Regionals list. It was also named an Inc. Power Partner in 2023 and 2024, and to Fast Company’s Next Big Things in Tech list in 2024, as well as HousingWire’s Tech100 list in 2025. To date, RentRedi has more than $28 billion in assets under management with nearly 200,000 landlords and tenants using its platform. The company partners with technology leaders such as Zillow, TransUnion, Experian, Equifax, Realtor.com, Lessen, Thumbtack, Plaid, and Stripe to create the best customer experience possible. For more information visit RentRedi.com.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/3054c495-1990-46b7-b58b-45792a65b570

https://www.globenewswire.com/NewsRoom/AttachmentNg/148eb0b8-2512-4a3c-82e4-3f6af3bb3394

RentRedi Media Contact: Jennifer Tolkachev jen@rentredi.com

How Landlords Verify Renters Insurance Coverage

A joint survey from RentRedi and BiggerPockets shows that half of landlords don’t currently verify renters insurance, while others rely on manual checks, insurance confirmations, or property management software, highlighting opportunities to streamline the process with technology.

Smaller Landlords Lead on Renters Insurance Enforcement

A RentRedi survey shows smaller landlords are more likely to require and enforce renters insurance, while landlords of all sizes can benefit from automated solutions that simplify compliance and reduce administrative work.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.